World Trade 2025 and Outlook for 2026: The «Wall» at Kilometre 30 and the Great Turning Point

An analysis report by TRADE&TRAIL

In the world of running, it is said that a marathon does not really start at the starting line, but when your legs give way, your glycogen reserves are depleted and your body is drained as you reach that physical and mental limit known to all runners as «the wall». Well, in 2025, international trade has reached its own «wall».

After analysing the final reports from the WTO and UNCTAD on the year 2025, the conclusion of our research confirms what we have been warning about at Trade & Trail. Following on from our previous analyses — where we examined the World Trade Results for 2024 and outlined the Outlook for 2025 — today we confirm that this is not just another cycle.

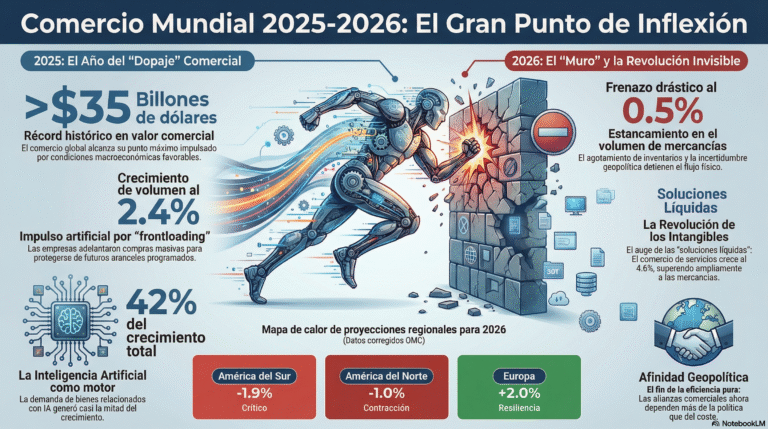

We have gone from running on flat asphalt to entering an unknown technical route where global trade has surpassed the record barrier of $35 trillion but with signs of obvious physical exhaustion.

I. 2025 ANALYSIS: The Illusion of US Frontloading

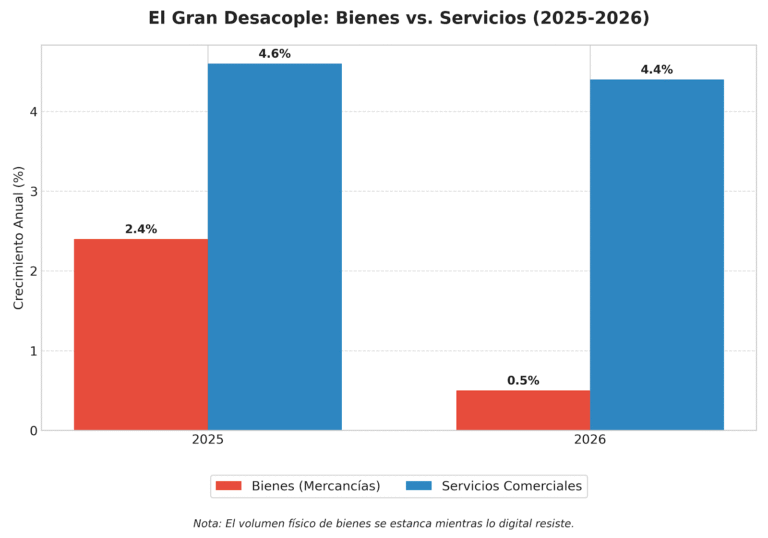

Macroeconomic figures can be misleading if not read with a magnifying glass. 2025 closed with a 2.4%growth in merchandise trade volume. At first glance, this would seem to be a sign of health. However, when we delve into the customs data, we discover that this growth was artificially inflated.

The main driver was not an organic increase in global demand, but fear.

The United States experienced a massive phenomenon of frontloading (advance ordering). Faced with the certainty of a tariff increase scheduled for 2026, US importers increased their purchases by 7% during the second and third quarters of 2025. They filled their warehouses not to sell today, but to protect themselves from tomorrow’s costs. This has created a «false positive» in the statistics that will inevitably lead to an inventory hangover in the first half of 2026.

But the real revolution was happening in silicon.

AI-related goods (chips, processors, servers) grew by almost 20% in value. Although these products account for only 15% of world trade, they were responsible for 42% of all trade growth for the year.

If we remove AI from the equation, traditional trade is barely trotting along.

The Mutation of Value: The Revolution of Intangibles

While containers piled up in ports on the US West Coast, something quieter but more profound was happening.

Trade in commercial services grew by 4.6%, decoupling itself from industrial stagnation.

It is no longer a question of comparing the digital with the physical, but of understanding the value proposition. In an environment where crossing a physical border is increasingly expensive and slow (due to tariffs and administrative bureaucracy), companies have opted to export «liquid solutions».

Instead of exporting only machinery (subject to tariffs), leading companies are exporting know-how, predictive maintenance software and remote engineering.

It is a pure marketing strategy: selling the result, not just the object, thus circumventing traditional customs barriers and highlighting the importance of both intellectual property and technology transfer.

But the revolution does not end with what you sell, but how you manage it. This is where SMEs find their true entry point into the Artificial Intelligence value chain.

Until recently, high-level logistics optimisation was the exclusive domain of multinationals. Today, AI democratises that capability. A small business no longer needs a data analysis department; it can integrate generative AI tools to predict stock shortages, automate complex customs procedures or translate technical documentation in real time. The main channel for an SME to integrate into this new economy is not to manufacture the chip, but to use AI to eliminate the inefficiencies that previously made it less competitive against the giants.

A clear example can be found in customs simplification. There are already AI projects accessible to SMEs capable of automating the complex assignment of tariff codes (HS Codes). What used to consume resources and generate legal uncertainty is now solved by algorithms that read the product description and assign the exact heading.

The main channel for an SME to integrate into this new economy is not to manufacture the chip, but to use AI to eliminate the bureaucratic inefficiencies that previously made it less competitive against the giants.

«AI is not an option, it is the paradigm shift that will allow SMEs to compete nimbly against giants in foreign markets.»

II. OUTLOOK FOR 2026: Welcome to the Ultra Trail of Commercial Geopolitics

If 2025 was the «wall» of the marathon, 2026 changes the discipline.

We are no longer in a sprint; we have entered an Ultra Mountain Trail. The terrain is uneven, the geopolitical climate is changeable, and the forecast for reaching the finish line (economic growth) is becoming more uncertain.

In fact, according to the latest projections from the WTO and the World Bank compiled for this article, growth in the volume of goods by 2026 will slow to a meagre 0.5%.

📊 Snapshot: A Complex Analysis of the Current State of World Trade

Before dissecting the opportunities for global trade in 2026, it is imperative to take a closer look at the complex X-ray of the current situation.

We are facing a technical stagnation in global volume (+0.5%), which is acting as a brake on the traditional economy. But the real challenge lies not only in quantity, but also in cost and fluidity.

Freight price volatility has become chronic, fuelled by an ongoing crisis in the Red Sea and persistent operational restrictions in the Panama Canal.

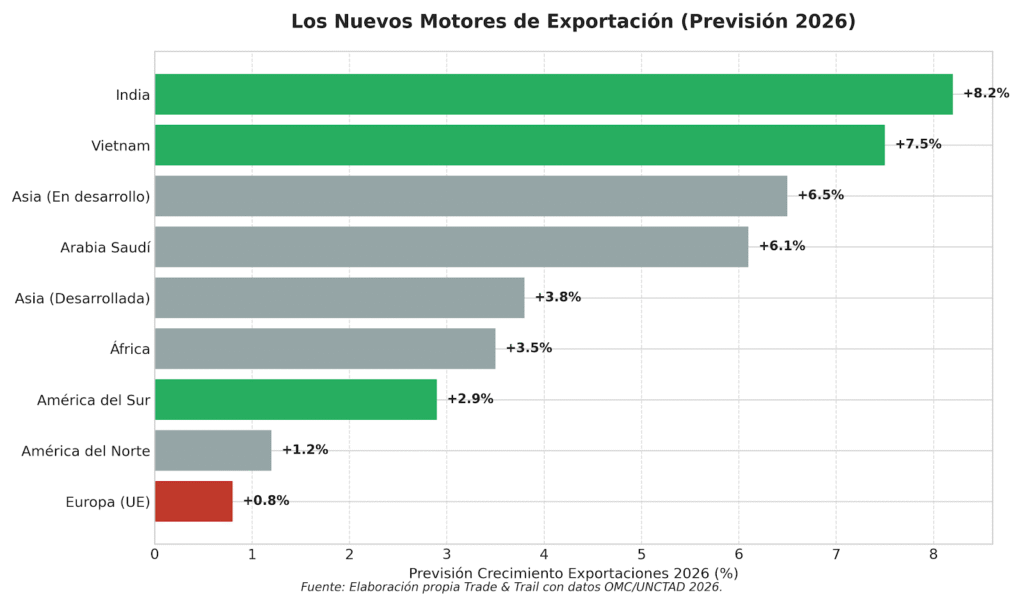

Added to this is a tectonic shift in the players on the board: the centre of gravity for growth has definitively shifted from the Atlantic to the corridor linking the Pacific and Indian Oceans.

However, the most formidable obstacle facing companies this year is not tariff-related, but regulatory. Regulatory fragmentation has become an invisible barrier, much more difficult to overcome than traditional customs duties.

Furthermore, volatility is no longer cyclical, but structural. More than 90% of world trade now depends on financing, which exposes supply chains to any tightening of credit conditions or debt crises in emerging markets.

This scenario is consolidating a change in vocabulary in boardrooms.

The buzzwords are no longer ‘Just in Time’ or ‘Cost Efficiency’; the new currencies of trade are resilience, redundancy and security. And this trend is here to stay.

We have seen how the new geopolitics is forcing even the most purely commercial operators to sacrifice margin for certainty, prioritising redundant supply chains (having two suppliers instead of one cheap one). The macroeconomic consequence is inevitable: a structural increase in the cost of consumer goods and, in relative terms, a lower volume of goods crossing borders. This is the price to pay for insurance against global chaos.

«We have gone from running on flat asphalt to venturing onto an unknown technical route: the Ultra Trail of Commercial Geopolitics.»

III. HEAT MAP: Winners, Losers and Data by Region

To understand where to focus, we have cross-referenced export data from the last quarter with IMF and WTO projections, producing an analysis that goes beyond simple figures.

We observe a general slowdown where market selection will be critical.

Table 1: Export Growth Projection (Volume of Goods) 2026

Region | 2026 Growth Forecast | Trend | Key Observations |

Asia | 0.0 | 🟡 Stagnation | Abrupt slowdown after leading in 2025. Manufacturing suffers. |

Africa | 0.0 | 🟡 Resilient | Maintains levels thanks to demand for resources, but without expansion. |

North America | -1.0 | 🔴 Contraction | The frontloading of 2025 takes its toll; inventory adjustment. |

South America | -1.9 | 🔴 Critical | Sharp drop in export volume; need to refocus on value. |

Europe (EU) | +2.0 | 🟢 Opportunity | Surprising relative resilience compared to the rest of the world. |

CIS (Commonwealth of Independent States) | +3.5 | 🚀 Rebound | Technical recovery from a low base. |

Source: Own elaboration based on WTO data

IV. THE GIANT AWAKENS: The EU-India Agreement and the Trade «Sorpasso»

February 2026 brought news that is redrawing the map: significant progress in the EU-India Free Trade Agreement.

While media attention was focused on China, India has been doing its homework.

This agreement is not just paper; it is the opening of a market of 1.4 billion people for European technology and machinery. India is positioning itself as the democratic and secure alternative for the global supply chain.

The Fact: German and Italian machinery exports to India grew by 14% year-on-year in January 2026.

The Opportunity: India needs infrastructure and technology for its «Make in India» plan. European SMEs that manufacture industrial components have found their new «El Dorado» here, replacing their dependence on the Chinese market, which is closing.

V. LATIN AMERICA: Mercosur as a Strategic Refuge

Another market that will be key, not only in 2026 but in the coming years, is Mercosur. For Spanish companies, looking to Asia is necessary, but looking to Latin America is natural.

In 2026, when sea routes to the East are expensive and dangerous, the South Atlantic emerges as an area of relative stability.

Although freight volume projections for South America are challenging (-1.9% in exports by 2026), the region remains strategic for one reason: critical minerals.

However, there is a caveat in the UNCTAD data: the fall in lithium and cobalt prices (which have fallen between 18% and 39% from their peaks) is discouraging investment in new mines. For Mercosur countries, the challenge in 2026 is not only to extract, but also to process locally to avoid commodity volatility.

The EU-Mercosur Agreement, currently awaiting the outcome of the CJEU (Court of Justice of the European Union) ruling, remains a key piece on the board.

Despite the legal uncertainty, commercial reality is moving forward:

Brazil is not just a soybean exporter; its industry demands precision agricultural technology (Agrotech), in which Europe is a leader.

Uruguay and Chile are consolidating their positions as hubs for digital services and secure logistics.

For a European SME, and in particular a Spanish one, Mercosur acts as a safe «refuelling station» in the race: a culturally similar market with a demand for quality that remains intact.

VI. CONCLUSIONS: How to finish the race

To conclude this analysis, at TRADE&TRAIL we conclude that 2026 will be a year in which it will not be the fastest who wins, but the most resilient.

«In 2026, trade geopolitics will be as important in companies’ bottom lines as economic efficiency itself.»

The «wall» is already here; therefore, our advice for exporting SMEs for 2026 is as follows:

1. Forget volume inertia: With America and Asia slowing down their export volumes, competition will be fierce. Don’t try to sell more quantity, look for higher margin niches.

2. AI is not optional: If AI generated 42% of trade growth in 2025, your company must integrate itself into that value chain, either by adopting technology or by serving that sector. AI will be the tool that allows small businesses to democratise their logistics and compete in agility against the giants, breaking down the barriers to entry that size previously imposed.

3. Services over goods: With a flat forecast for goods in 2026 (+0.5%) but dynamic growth in services (+4.4%), explore how to package your product as a service.

Global trade continues to run, but the route has changed. Only those who stop looking at the road and look up at the data will reach the finish line.

And remember, as we always say…

THERE IS LIFE BEYOND TURKEY!!