Considering the current 2025 start dates, in this article, we will explore the trends that are shaping the global landscape, the sectors with the greatest potential and the countries and regions that will be the focus of world trade in 2025.

Analysing the publications on world trade trends produced by the main international organisations (WTO, UN, UNCTAD, FAO, World Bank) and specialised consultancies.

Sectors with growth potential

According to the World Trade Organization (WTO), during 2025 the trade in goods and services could grow at a rate of 3% per year in 2025 reaching 27.8 billion $.

Identifying the following sectors as key not only for 2025 but also for the coming years:

1. Electronic Commerce

The COVID-19 pandemic has profoundly transformed global trade, accelerating the adoption of digital technologies and highlighting the role of e-commerce as one of the main avenues for business development. This phenomenon has been particularly noticeable in emerging markets, where digitization is facilitating access to international markets.

According to UNCTAD (United Nations Conference on Trade and Development), global cross-border e-commerce sales are expected to reach an all-time high of $4.8 trillion by 2025, representing 17% of world trade, having doubled in just 5 years.

Main countries and regions

UNCTAD identifies Asia and North America as the regions that will lead this growth.

In Asia, China and India stand out: The main drivers of electronic commerce.

China, which already accounts for more than 50% of global e-commerce sales, will continue to play a leading role; especially with platforms like Alibaba and JD.com.

While in North America, the United States and Canada stand out: These two countries are experiencing significant growth, mainly due to the presence of companies such as Amazon and Shopify, which are facilitating SMEs' access to international markets.

Impact on emerging markets

E-commerce is also transforming emerging markets, providing new opportunities for local businesses to compete on the global stage. In regions such as Africa and Latin America, digital platforms are removing traditional barriers to trade, such as lack of physical infrastructure and limited distribution capacity.

In Latin America, platforms like Mercado Libre are leading this digital revolution, facilitating consumers' access to international products and fostering local business growth. On the other hand, Africa is seeing a boom in the use of fintech solutions and electronic payment services such as M-Pesa, which are improving financial inclusion and allowing traders to participate more actively in global trade.

In conclusion, the foreign trade in 2025 will be marked by the boom of e-commerce, led by Asia and North America. Technological advances, together with the growth of emerging markets, are redefining the rules of the game and creating a more dynamic landscape.

2. Renewable Energy

The transition to clean energy continues to accelerate, with important implications for both climate change and international trade.

With China, the European Union and the United States leading solar and wind energy exports, and green hydrogen emerging as a new player, the future of global renewable energy trade promises unprecedented growth by 2025 and beyond.

The global turnover of renewable energy trade is estimated at more than $4 trillion by 2025, representing 14% of world trade; driven mainly by: solar panels, wind turbines, storage and battery technologies and green hydrogen and electrolysis.

Main countries and regions

China: The Giant Exporter of Renewable Technologies. Its renewable energy exports are expected to increase to $65 billion by 2025 thanks to growing demand in Europe, Latin America and Africa; mainly focused on wind turbines and lithium-ion batteries.

European Union: Innovation and High Quality. European technology, recognized for its high efficiency and quality, will remain competitive with Asian products, notably:

- Germany and Denmark in the export of advanced wind turbines, with a projected market of $ 20 billion by 2025.

- Spain and France in the green hydrogen electrolysis trade, an emerging market that could reach $2 billion in exports by 2025.

United States: Promotion of Local Production and Exports. Driven by the Inflation Reduction Act (IRA), it is increasing the manufacture and export of solar panels, wind turbines and batteries. Exports of renewable technologies could exceed $30 billion by 2025.

Japan and South Korea: Hydrogen and Battery Innovators. Both countries are world leaders in advanced hydrogen electrolysis and battery technology, with joint exports projected to be $15 billion by 2025, in response to growing global demand.

Featured products in foreign trade: Green Hydrogen

International trade in green hydrogen is at an early stage, but with high growth potential, being a clear emerging market, and in which the following stand out:

- Australia and Chile are major exporters thanks to their ability to produce green hydrogen at low cost using solar and wind energy.

- Middle East, led by Saudi Arabia and the UAE, which are investing massively in hydrogen projects; mainly destined for the EU and Japan.

3. Sustainable products

The sustainable product market is transforming international trade, driven by growing investments in clean technologies. By 2025, this growth is expected to be led by the export of recycled textiles, biodegradable packaging and organic food. Estimates indicate that the foreign trade of these products in 2025 will be around $1.06 trillion, representing 4% of world trade.

Key Regions and Countries in Sustainable Trade

European Union: Green Innovation Focus. Leading the global market for sustainable products, driven by strict environmental regulations and strong domestic demand, including: Germany and the Netherlands, which lead the export of green technologies and recycled products.

Asia: Expansion in Production and Export, highlighting: China, which dominates the production of recycled textiles and biodegradable packaging. Japan and South Korea focus on innovative technologies to reduce environmental impact.

Latin America: Sustainability in the Agri-food Sector, highlighting: Brazil and Argentina are leaders in exports of organic foods. Chile, which is increasing its share of biodegradable packaging.

Products of foreign trade

Recycled Textiles: Innovation and Sustainability: By 2025, growth is expected to reach $19.5 billion. Key countries in this segment will be: China (main exporter) and European countries such as Germany and Italy (leaders in sustainable textile innovation focusing on high quality materials).

Biodegradable Packaging: Response to the Plastics Crisis: By 2025, exports could exceed $12 billion, led by: US (main exporter to key markets such as the EU and Asia) and India (emerging country thanks to the development of circular economy).

Organic Food: Growth in Premium Markets. The organic food market is booming. The value of this market is projected to increase to $75 billion in 2025, highlighting: Brazil and Argentina (as leading exporters of products such as grains, fruits and meats to the EU and the US) and the EU (although focused on intra-European trade in fresh and processed products).

4. Health and Biotechnology

Health and biotechnology are emerging as key sectors in international trade, driven by growing investment in R&D and the need for innovative solutions in global health. International trade in these sectors is expected to reach historic levels by 2025, with pharmaceuticals, advanced medical devices and biotechnological therapies as the main drivers of this growth.

According to the World Trade Organization (WTO), health-related products will account for a significant proportion of global trade, with exports of medicines reaching over $1 trillion; representing 3.5% of global trade.

Key products and participating regions

Medicines and vaccines: The COVID-19 pandemic has highlighted the importance of vaccines and preventive treatments, generating a boom in demand. In addition, the need for affordable generic medicines has strengthened the pharmaceutical sector as a key player. Highlighting countries, such as: USA, EU (mainly Germany) and India (mainly in generic medicines).

Advanced medical devices: Surgical robots, portable scanners and portable health monitors are the most demanded devices, driven by technological advances and a growing need for affordable medical solutions. Highlighting countries such as: Japan, South Korea and the EU (mainly Germany).

Biotechnological therapies: Messenger RNA-based therapies and monoclonal antibodies are transforming the treatment of chronic and genetic diseases, positioning these nations as leaders in R&D, mainly highlighting: USA and Switzerland.

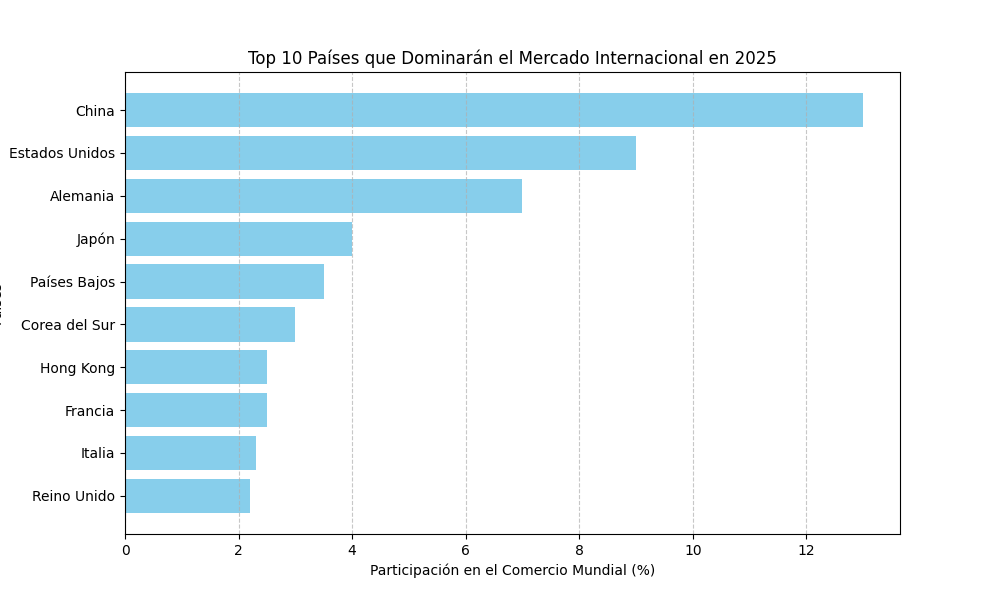

World Trade Leaders in 2025

For the top 10 countries that will dominate the international market in 2025 and their sectors, the following list has been drawn up on the basis of studies and analyses of world trade prospects prepared by major international organizations:

- China: World Trade Centre. It will be the leading country in world trade, accounting for 13% of it. And in sectors such as: electronics, machinery and textiles.

- United States: Will remain important worldwide. Representing 9% of global trade, with a strong presence in sectors such as: Technology, Automobiles and Pharmaceuticals.

- Germany: Will remain the most important European actor. Represented 7% of world trade and was prominent in the following sectors: Automobiles, machinery and chemicals.

- Japan: Will account for 4% of world trade, with a focus on: Cars, electronics and machinery.

- Netherlands: Its share in world trade will be 3.5%, mainly in: Chemicals, machinery and processed foods.

- South Korea: With a 3% to 9% share globally, with a strong presence in sectors such as: Electronics, automobiles and chemicals

- Hong Kong: Accounting for 2.5% of world trade, mainly in: Electronics, watches and jewellery.

- France: Also represented 2.5% of world trade and focused on: Aeronautics, cars and luxury goods.

- Italy: With a 2,3% shrare in global trade ans prominent in Machiney, luxury goods and food.

- United Kingdom: Accounting for 2,2% of world trade and prominent in: pharmaceuticals, cars and machinery.

It is important to note that only these three countries (China, the USA and Germany) will account for almost 30% of world trade.

It is also significant to note the absence of BRICS countries in this global top-10 for 2025.

Among them, India has increased its presence in international trade, especially in sectors such as information technology and pharmaceuticals. Its share in world trade is estimated at 2.1%.

Global trends and challenges

After this analysis of the main sectors to be taken into account for next year in world trade, it is important to make a special mention both of the global trends that are presented and of the challenges that we will have to face.

Key Trends

Among the key trends, and as we have pointed out in the article there are three key issues that should be noted:

- Sustainability: Sustainability is becoming a key pillar of business success. According to the UN’s "Global Sustainability Outlook 2023" report, 90% of global companies are expected to implement sustainability strategies by 2025. In addition, investments in sustainable technologies could reach $2.5 trillion annually.

- Digitalization: Digitization continues to revolutionize business processes. In this regard, the World Bank estimates that 75% of medium and large enterprises will have adopted artificial intelligence and big data-based solutions by 2025, improving their operational efficiency by an average of 30%.

- Emerging Markets Expansion: According to the IMF (International Monetary Fund), emerging markets such as Africa and Southeast Asia could account for 50% of global trade growth by 2025. Focusing mainly on sectors such as technology and consumer goods.

Challenges

However, both 2025 and the years ahead present a number of challenges for international trade that will have to be addressed, including:

Protectionism: According to the WTO, it is estimated that protectionist policies could cost global trade up to $1.6 trillion in losses by 2025. Highlighting mainly the application of higher tariffs and trade restrictions affecting key sectors such as technology and agriculture. The application of measures in more or less measures of these protectionist policies will be strongly determined by trade geopolitics.

Exchange Fluctuations: According to data from the BIS (Bank for International Settlements), fluctuations in exchange rates could generate volatility of up to 15% in global exports. This will particularly impact companies with internationalized supply chains.

Supply Chain Disruptions: As seen during 2024, logistics disruptions could cause losses of up to $3 trillion per year in 2025 (according to McKinsey); so diversification and technology will be essential to mitigate these risks.

Conclusion

Global trade is undergoing a profound transformation, marked by digitalization, sustainability and growing global interconnectedness.

By 2025, global trade will be marked by a dynamic and complex environment in which great opportunities are expected in e-commerce, renewable energy and sustainable products.

Success will depend on the ability to adapt to global trends, take advantage of new technologies, diversify markets and address the challenges of protectionism and logistical disruption, which will require resilient strategies.

And as we have seen the structural changes in international trade during the last years, such as the emergence of the Asia-Pacific region as a clear reference for world trade and the emergence of emerging economies such as Latin America, Africa and the Middle East. As well as the development of new business sectors focused on digitization and decarbonization.