Comercio Mundial 2024: Principales Resultados

El comercio mundial enfrenta una transformación marcada por dinámicas regionales, y la importancia de la digitalización y descarbonización.

Coincidiendo con el final de este año 2024, en este artículo presentaremos un análisis de los datos clave de comercio global en 2024, desglosados por regiones y países, y principales sectores exportadores.

Datos Globales

El comercio mundial ha mostrado una notable recuperación y crecimiento en 2024, con un incremento del 3.7% en el comercio de bienes y servicios, alcanzando un valor total de 26,7 billones $, según el Informe del Comercio Mundial 2024 de la Organización Mundial del Comercio (OMC).

Este crecimiento ha sido impulsado principalmente por la demanda de productos tecnológicos, sostenibles y alimentos procesados. Estos sectores, asociados a la digitalización y descarbonización global, han sido cruciales para el crecimiento económico del siglo XXI.

Análisis Regional

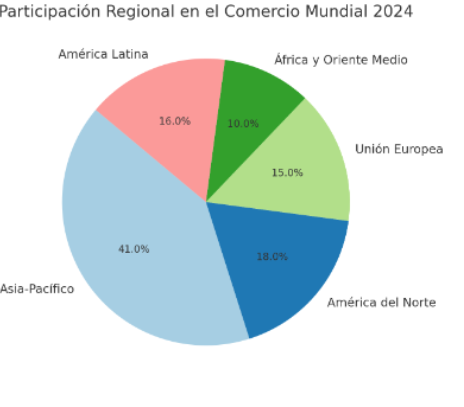

Por regiones, el comercio mundial del 2024 de distribuyó de la siguiente manera

- Asia-Pacífico: Se consolidó como la región comercial más dinámica y líder del comercio mundial, representando el 41% del total. Destacando principalmente China, que fue el país que lideró las exportaciones mundiales con un crecimiento del 5,2% respecto al año anterior. Siendo las exportaciones claves de esta región tanto los productos tecnológicos (+9,1%) como los textiles (+6,3%). Consolidándose el cambio estructural del comercio exterior de esta región con exportaciones de alto valor añadido.

- América del Norte: Representó la segunda región comercial del mundo con el 18% del comercio mundial (aunque a gran distancia de la región Asia-Pacífico). Destacaron principalmente dos países: Estados Unidos y México. Estados Unidos experimentó un crecimiento del 4.8% de sus exportaciones; principalmente de bienes tecnológicos y productos agrícolas. Mientras que, por su parte, México se consolidó como un hub manufacturero clave, con un crecimiento del 7.5% en exportaciones de automóviles y componentes.

- América Latina: Fue la región que mayor dinamismo comercial mostró (junto con la región de Asia- Pacífico). De hecho, se llegó a situar como la tercera región comercial del mundo con un 16% del total mundial. Destacando dos países: Brasil y Chile. Brasil lideró las exportaciones de la región con un crecimiento del 6.4%, gracias a la soja y productos minerales. Mientras que Chile destacó en exportaciones de litio (+9.3%), impulsado por la creciente demanda de baterías para los vehículos eléctricos.

- Unión Europea: Finalizó el año 2024 como cuarta región comercial con un 15% del total de las exportaciones mundiales. Desatacando principalmente Alemania e Italia. Alemania continuó como líder regional, con exportaciones de maquinaria y equipos industriales en crecimiento (+4.2%), mientras que Italia destacó por su incremento en exportaciones de alimentos procesados (+6.1%).

- África y Oriente Medio: La región de África y Oriente Medio a pesar de situarse como la última región comercial experimentó un importante crecimiento durante el año 2024 llegando a representar el 10% del comercio global. Este crecimiento se debió principalmente al crecimiento del comercio interregional (+5.8%), impulsado por el Tratado de Libre Comercio Africano (AFCFTA). Siendo las exportaciones claves tanto los productos energéticos como agrícolas.

Principales sectores de exportación

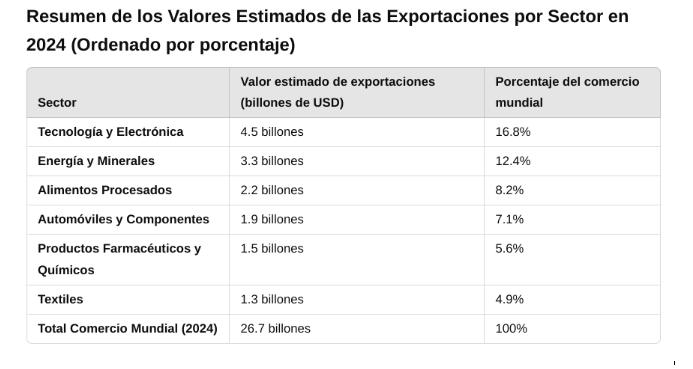

Respecto a los sectores exportadores, en el año 2024 el comercio internacional estuvo dominado por seis sectores que representaron el 55% del total de las exportaciones mundiales; siendo:

- Tecnología y Electrónica La tecnología sigue siendo el sector más dinámico a nivel mundial y el sector líder, representando el 16,8% del comercio mundial. Con un crecimiento estimado de +9,1% en las exportaciones tecnológicas, la demanda de productos como semiconductores, dispositivos electrónicos, y equipos de telecomunicaciones ha alcanzado niveles récord. En particular, los países asiáticos, especialmente China, se han consolidado como los principales exportadores de estos productos. Por otro lado, EEUU también destacó en el año 2024 presentando un crecimiento significativo de +4.8% en sus exportaciones, especialmente en semiconductores y tecnología avanzada.

- Energía y Minerales Los productos energéticos y minerales han sido fundamentales en las exportaciones de regiones como América Latina, África y Oriente Medio; siendo el segundo sector en importancia durante el 2024, representando el 12,4% del comercio mundial. En este sentido, es importante destacar el elevado crecimiento experimentado por los minerales críticos; como por ejemplo el litio, que ha experimentado un crecimiento de +9.3% en exportaciones, impulsado por la demanda de baterías para vehículos eléctricos; destacando países como Chile en el litio y Brasil en la exportación de productos minerales.

- Alimentos Procesados El sector de alimentos procesados siguió siendo un pilar clave del comercio internacional representando el 8,2% del comercio mundial; y experimentado un crecimiento de +6.1% especialmente en mercados emergentes. Las exportaciones de productos agrícolas y alimentos procesados han sido un motor de crecimiento para países como México, Brasil y Alemania.

- Automóviles y Componentes La exportación de automóviles y sus componentes se situó como cuarto sector exportador, con un 7,1% de las exportaciones mundiales. Siendo una de las áreas con mayor dinamismo en América Latina, con México destacando como un hub manufacturero clave en el comercio internacional.

- Productos farmacéuticos y químicos; sector que ha crecido, impulsada por la recuperación post-pandemia y el aumento de la demanda de medicamentos y productos químicos industriales. El valor de las exportaciones farmacéuticas y químicas en 2024 se situó en 1,5 billones $, representando el 5.6% del comercio mundial. Destacando países como Suiza, Alemania y Estados Unidos, que son los principales exportadores en este sector.

- Textiles El sector textil también ha mostrado un crecimiento considerable, con un aumento de +6.3% en las exportaciones; y representando el 4,9% del comercio mundial. El crecimiento ha sido impulsado por los avances en sostenibilidad y las demandas de productos textiles eco-sostenibles; liderado por China que sigue siendo el principal exportador de textiles a nivel mundial, con un crecimiento robusto en este sector.

Conclusión

El comercio mundial está atravesando una etapa de transformación profunda, marcada por la digitalización, la sostenibilidad y la creciente interconexión global.

El comercio mundial en 2024 mostró un crecimiento sólido, liderado por regiones clave como Asia-Pacífico y sectores como tecnología y sostenibilidad; destacando también el crecimiento de la región de América Latina que llegó a superar a la UE en el cómputo de exportaciones globales.