Geopolítica Comercial: La Importancia del Mar del Sur de China y el Dominio de los Microchips

Como continuación de nuestros artículos sobre geopolítica comercial, este mes hemos decidido hacer un artículo especial sobre la importancia que tiene el sudeste asiático y sobre todo la zona del Mar del Sur de China y del Estrecho de Malaca, para resaltar de manera especial como la geoestrategia y el comercio internacional actual se centra en el sudeste asiático.

Demostrado una vez más que tal y como siempre decimos: “HAY VIDA MÁS ALLÁ DE TURQUÍA !!”

Sudeste Asiático: Centro del Comercio Internacional

El Mar del Sur de China y el Estrecho de Malaca son dos de los puntos más estratégicos en la geopolítica comercial global. El Mar del Sur de China, por donde transita el 60% del comercio marítimo mundial, es una ruta vital para el transporte de energía y mercancías conectando economías clave como China, Japón y Corea del Sur. Además, alberga importantes reservas de petróleo y gas, lo que lo convierte en un escenario de tensiones territoriales y rivalidades entre potencias, especialmente entre China y Estados Unidos.

Ambas rutas no sólo son esenciales para el comercio internacional, sino también escenarios clave en la rivalidad entre China y Estados Unidos, donde el control de estas vías marítimas y la influencia sobre Taiwán, el corazón tecnológico del mundo, definen el futuro de la geopolítica comercial.

La estabilidad de estas regiones es fundamental para garantizar el flujo continuo del comercio mundial, pero las tensiones en aumento podrían alterar el equilibrio global del que hasta ahora hemos gozado.

El Dominio de China sobre el Comercio Mundial

China no sólo es el mayor exportador mundial, con una media de 3.6 billones$ en exportaciones al año sino que también controla directa o indirectamente algunos de los puertos más importantes del mundo. Esta red de puertos estratégicos le permite influir en las rutas comerciales globales y consolidar su posición como líder en el comercio internacional.

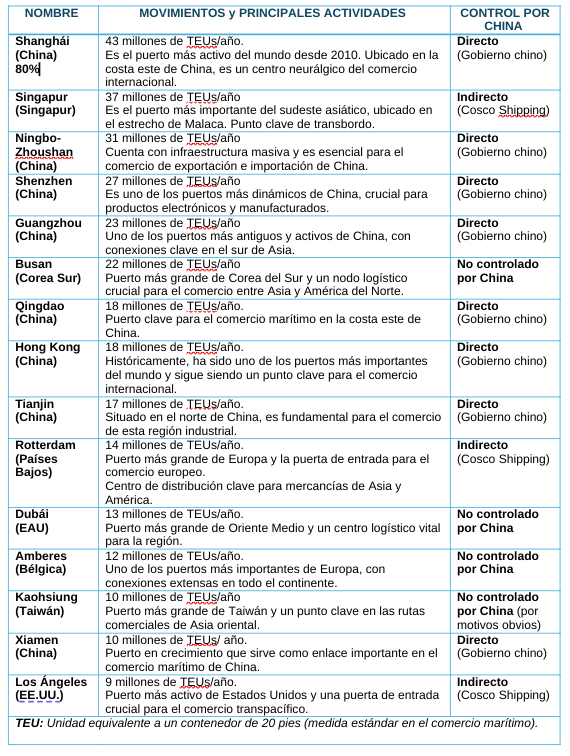

Lista de los 15 Principales Puertos Comerciales y su control por parte de China

Todos estos datos subrayan tanto la importancia estratégica de China en el comercio mundial como la situación geoestratégica fundamental que juegan el Mar del Sur de la China y el Estrecho de Malaca en el actual funcionamiento del comercio mundial.

De la tabla anterior, podemos sacara las siguientes conclusiones:

- Los 5 principales puertos mas grande del mundo se encuentran situados en las aguas del Mar del Sur de China

- Además, 9 de los 15 principales puertos del mundo se concentran en las aguas del Mar del Sur de China.

- China tiene el control directo o indirecto de 11 de los 15 puertos mas importantes del mundo: 9 de manera directa (a través del gobierno chino) y 2 de manera indirecta (a través del Cosco Shipping)

- Y, además China controla de manera directa 7 de los 10 primeros puertos del mund0

El Mar del Sur de China: Un Eje Estratégico en la Geopolítica Comercial Global

El Mar del Sur de China, una vasta extensión marítima que conecta el noreste y sudeste de Asia con el Océano Índico y el resto del mundo, se ha consolidado como un punto neurálgico en la geopolítica comercial global. Su trascendencia radica en su papel como una de las rutas marítimas más transitadas del mundo, por donde circula aproximadamente el 60% del comercio marítimo global, lo que equivale a más de 3.4 billones $ en mercancías anuales.

Esta región marítima actúa como un puente esencial para el comercio internacional, facilitando el transporte de materias primas, productos manufacturados y recursos energéticos. Las principales rutas comerciales que atraviesan el Mar del Sur de China conectan economías clave como Japón, Corea del Sur y China, que dependen en gran medida del comercio marítimo para su desarrollo.

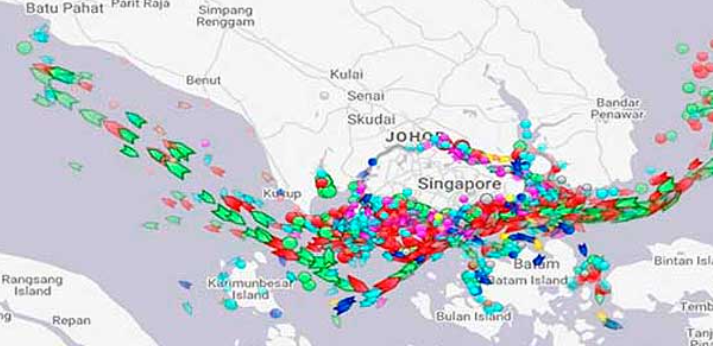

Por otro lado el Estrecho de Malaca, una vía marítima estratégica y una de las más congestionadas del planeta, se encuentra en la zona de influencia del Mar del Sur de China; lo que aumenta significativamente su importancia. Este estrecho actúa como una puerta de entrada crítica al Mar del Sur de China, a través del cual transita una gran parte del comercio mundial, incluido el petróleo proveniente de Oriente Medio.

Un Escenario de Tensiones Geopolíticas

Pero la importancia estratégica del Mar del Sur de China no se limita al comercio, ya que esta región también alberga significativas reservas de petróleo y gas natural; lo que la convierte en un punto clave para la seguridad energética de muchos países.

Sin embargo, las reclamaciones territoriales de China basadas en la denominada «línea de los nueve puntos» han generado tensiones geopolíticas significativas con sus países vecinos como Vietnam, Filipinas, Malasia y, de manera especial, Taiwán.

Estas tensiones además se han exacerbado tanto por la construcción de islas artificiales y la militarización de la zona por parte de China; como por las actuaciones de Estados Unidos desafiando las reclamaciones territoriales de las aguas del Mar del Sur de China y defendiendo el derecho martítimo internacional.

A todo esto, hay que añadir que la creciente rivalidad entre Estados Unidos y China está convirtiendo esta región en un punto constante de fricción en la geopolítica mundial.

Un Punto de Inflexión para el Comercio Mundial

Hablando en términos comerciales, la alta dependencia del comercio marítimo global en el Mar del Sur de China subraya su importancia para la economía mundial. De hecho, los puertos ubicados en el Mar del Sur de China, y especialmente aquellos controlados por China, desempeñan un papel fundamental en el comercio mundial actuando como centros de distribución y hubs que facilitan el movimiento de mercancías.

Por tanto, el Mar del Sur de China se ha consolidado como un eje estratégico en la geopolítica comercial mundial donde convergen intereses económicos, energéticos y estratégicos de diversas potencias. Por lo que la gestión de las tensiones en esta región es crucial para garantizar la estabilidad del comercio internacional y la seguridad energética global.

El Estrecho de Malaca:

Un Cuello de Botella Estratégico en la Geopolítica Comercial Global

El Estrecho de Malaca, una angosta vía marítima que conecta el Océano Índico con el Mar del Sur de China y el Pacífico, se erige como un punto crucial para el comercio marítimo mundial. Su importancia radica en su capacidad para facilitar el flujo de mercancías entre Asia, Europa y el resto del mundo, consolidándose como una arteria vital para el transporte de energía, productos manufacturados y materias primas.

Con una longitud aproximada de 805 kilómetros y una anchura que se reduce a tan solo 2,5 kilómetros en su punto más estrecho, el Estrecho de Malaca es un verdadero «cuello de botella» para el comercio marítimo. Se estima que más de 100.000 buques transitan por este estrecho cada año, lo que equivale a una media de 250-300 barcos/día. Este intenso tráfico incluye petroleros, portacontenedores, graneleros y otros tipos de buques mercantes, que transportan aproximadamente el 25% del comercio marítimo global.

Flujos Comerciales y Productos Clave

En este sentido, el paso del Estrecho es particularmente crítico para el transporte de energía ya que alrededor del 80% de las importaciones de petróleo de China pasan por esta vía, procedentes de Oriente Medio. Además, una gran cantidad de productos manufacturados, contenedores, y materias primas como minerales, carbón y productos agrícolas fluyen a través del Estrecho consolidando su papel como un eje central para el comercio mundial.

De hecho, más del 50% del tonelaje anual de la flota mercante mundial pasa por este mar y un 33% de todo el tráfico marítimo.Un ejemplo, para poder comprender la importancia de este paso marítimo, es que el petróleo transportado a través del Estrecho de Malaca desde el Océano Índico en ruta hacia el este de Asia a través del Mar del Sur de China es más de 6 veces la cantidad que pasa por el Canal de Suez y 17 veces la cantidad que transita por el Canal de Panamá.

Así, aproximadamente el 66% de los suministros de energía de Corea del Sur, casi el 60% de los suministros de energía de Japón y Taiwán, y aproximadamente el 80% de las importaciones de petróleo crudo de China transcurren por la ruta Estrecho de Malaca – Mar del Sur de China.

Importancia para Asia y Europa

Por otro lado, este canal de comunicación es también una vía fundamental para el comercio entre Asia y Europa.

Una gran cantidad de mercancías destinadas a Europa desde Asia transitan por este Estrecho, lo que subraya su importancia para las economías europeas que dependen en gran medida de las importaciones asiáticas. De hecho, para China el Estrecho es vital para sus exportaciones a la Unión Europea.

Por lo que, al igual que comentábamos en relación con el Mar del Sur de China, cualquier interrupción en esta ruta tendría un impacto significativo en la economía mundial y especialmente en Europa, que depende en gran medida de las importaciones asiáticas.

Implicaciones Geopolíticas

Como venimos señalando, la ubicación estratégica del Estrecho de Malaca lo convierte en un punto de interés para las principales potencias mundiales.

Singapur, un aliado estratégico de Estados Unidos, alberga uno de los puertos más importantes del mundo en la entrada del Estrecho, lo que añade una dimensión geopolítica a su control. De hecho, el Estrecho de Malaca es vulnerable a riesgos como la piratería y el terrorismo.

En resumen, el Estrecho de Malaca es un punto estratégico en el comercio marítimo mundial con implicaciones significativas en la economía mundial y la geopolítica.

Taiwán: El Corazón Tecnológico en la Mira de las Potencias

Como hemos destacado, el Mar del Sur de China no solo es un eje comercial vital, sino un escenario clave de la rivalidad entre China y Estados Unidos. Más allá de las disputas territoriales y el control de rutas marítimas, la región alberga un elemento de importancia crítica: Taiwán, epicentro de la industria global de microchips.

Taiwán se ha consolidado como un actor indispensable en la guerra comercial entre China y Estados Unidos, especialmente en el sector de los microchips. La empresa taiwanesa TSMC, líder mundial en la fabricación de semiconductores, produce más del 50% de los chips a nivel global, y más del 90% de los chips más avanzados. Estos componentes son la columna vertebral de la industria tecnológica y militar, desde teléfonos inteligentes y computadoras hasta sistemas de defensa avanzados.

TSMC, representando más del 50% de la producción mundial de semiconductores avanzados, domina un mercado global que supera los 500.000 millones $ anuales. Los microchips fabricados en Taiwán se envían a todo el mundo a través de rutas marítimas que atraviesan el Mar del Sur de China y el Estrecho de Malaca; por lo que como venimos comentando cualquier bloqueo o interrupción en estas rutas afectaría gravemente la cadena de suministro global.

Los sectores más afectados incluyen:

- Industria Automotriz: Los automóviles modernos dependen de decenas, incluso cientos, de microchips para funciones como el control del motor, la asistencia al conductor, los sistemas de infoentretenimiento y la seguridad. De hecho, durante la escasez de microchips de 2020-2022, fabricantes como Ford, General Motors y Volkswagen se vieron obligados a reducir la producción o incluso cerrar temporalmente plantas debido a la falta de componentes. Esto dio lugar a retrasos en la entrega de vehículos y aumentos de precios.

- Electrónica de Consumo: Teléfonos inteligentes, computadoras, tabletas, consolas de videojuegos, televisores y electrodomésticos inteligentes dependen de microchips para su funcionamiento. De hecho, la escasez de microchips dificultó la producción de consolas de videojuegos como la PlayStation 5 X, lo que generó escasez y aumentos de precios. Los fabricantes de teléfonos inteligentes, como Apple y Samsung, también se enfrentaron a retrasos en la producción y posibles aumentos de precios.

- Industria Militar: Sistemas de defensa modernos, como misiles, aviones de combate, drones y sistemas de comunicación, dependen de microchips avanzados. De hecho, el sector militar es uno de los que más depende de microchips de última generación. Por lo que la falta de microchips podría retrasar la producción de sistemas de armas, afectar la capacidad de mantenimiento de equipos existentes y comprometer la seguridad nacional de los países.

- Infraestructura Crítica: Redes de telecomunicaciones, centros de datos, sistemas de control industrial, redes eléctricas y sistemas de transporte dependen de microchips para su funcionamiento. Por lo que la falta de éstos en un momento dado, podría interrumpir el funcionamiento de redes de telecomunicaciones, afectar la disponibilidad de servicios en la nube, paralizar la producción en fábricas y generar apagones.

- Inteligencia artificial: El desarrollo y la implementación de la IA dependen de microchips de alto rendimiento, como unidades de procesamiento gráfico (GPU) y unidades de procesamiento neuronal (NPU); demandando cada vez microchips mas potentes. Por lo que su escasez de podría retrasar el desarrollo de aplicaciones de IA en áreas como la medicina, la robótica, la conducción autónoma y el procesamiento del lenguaje natural.

De hecho, como ya pudimos observar y sufrir, la pandemia de COVID-19 reveló la fragilidad de las cadenas de suministro globales, especialmente en lo que respecta a los microchips. Las interrupciones en la producción y el transporte, exacerbadas por los confinamientos y las restricciones comerciales, provocaron una escasez mundial de semiconductores. Esto tuvo un impacto significativo en diversas industrias, desde la automotriz hasta la electrónica de consumo, evidenciando la dependencia global de un número limitado de proveedores.

En conclusión, tanto el Mar del Sur de China como el Estrecho de Malaca constituyen un mosaico de intereses estratégicos y tecnológicos, donde la rivalidad entre China y Estados Unidos se manifiesta con intensidad creciente. El control de Taiwán y su industria de microchips se ha convertido en un elemento clave de esta competencia, con implicaciones significativas para la seguridad global y la estabilidad económica. La pandemia de COVID-19 nos ha dado una muestra de lo que podría llegar a suceder si la cadena de suministro de microchips se viese interrumpida, y nos recuerda la importancia de proteger esta industria vital.

Conclusión Final: China y su Estrategia Geopolítica en el Comercio Mundial

En un mundo cada vez más interconectado y marcado por tensiones comerciales y geopolíticas, China ha emergido como un actor central en el comercio internacional desafiando el liderazgo tradicional de potencias como Estados Unidos y la UE. A través de una estrategia bien articulada que combina el control de puertos clave, la expansión de su influencia en el Mar del Sur de China y el dominio de rutas comerciales estratégicas como el Estrecho de Malaca; China ha consolidado su posición como una potencia global en ascenso.

El control directo o indirecto de 11 de los 15 puertos más importantes del mundo, junto con su influencia en el Mar del Sur de China, subraya la importancia estratégica de esta región para el comercio mundial. El Mar del Sur de China no sólo es una ruta vital para el transporte de mercancías y energía, sino también un escenario de tensiones geopolíticas entre China y otros países, así como con Estados Unidos. Estas tensiones, exacerbadas por las reclamaciones territoriales y la militarización de la zona podrían tener repercusiones significativas en la estabilidad económica y la seguridad energética global.

El Estrecho de Malaca, por su parte, representa un cuello de botella crítico para el comercio marítimo mundial, especialmente para el transporte de petróleo y productos manufacturados. Su importancia para las economías asiáticas y europeas lo convierte en un punto de interés estratégico para las principales potencias, incluyendo China y Estados Unidos. Cualquier interrupción en esta ruta podría tener consecuencias devastadoras para la economía global, especialmente en un contexto de creciente rivalidad entre estas dos potencias.

Además, Taiwán, como epicentro de la industria global de microchips, añade una capa adicional de complejidad a esta dinámica geopolítica. La dependencia global de los microchips fabricados en Taiwán, especialmente por parte de empresas como TSMC, hace que la isla sea un objetivo estratégico tanto para China como para Estados Unidos. La interrupción de la cadena de suministro de microchips, como se vió durante la pandemia de COVID-19, podría tener un impacto profundo en industrias clave como la automotriz, la electrónica de consumo, la defensa y la inteligencia artificial.

En resumen, la estrategia geopolítica de China en el comercio mundial, centrada en el control de puertos, rutas marítimas y la industria tecnológica refleja su ambición de convertirse en la primera potencia global. Sin embargo, esta ambición no está exenta de desafíos y riesgos, especialmente en un contexto de creciente rivalidad con Estados Unidos y tensiones en regiones clave como el Mar del Sur de China y Taiwán. La gestión de estas tensiones será crucial para garantizar la estabilidad del comercio internacional y la seguridad energética global en los próximos años.