La Revolución de la IA en el Comercio Internacional

IA en el Comercio Internacional

Para cerrar este primer trimestre queremos dedicar una publicación especial en nuestra sección de “Comercio Internacional” a explorar cómo la Inteligencia Artificial (IA) está redefiniendo las estrategias internacionales de las PYMES exportadoras.

Por Qué la IA es el Gran Cambio de Paradigma en el Comercio Mundial

En los últimos dos años, hemos asistido a una transformación sin precedentes en las cadenas globales de valor. La inteligencia artificial ha dejado de ser un concepto futurista para convertirse en el motor principal de competitividad en el comercio internacional.

Según el último estudio de la OMC (2024): “El impacto de la IA en el comercio internacional” estamos ante la mayor disrupción tecnológica desde la invención del contenedor de mercancías en los años 50. De hecho, según datos del Observatorio de Comercio Internacional (2024), el 78,3% de las PYMES exportadoras que han adoptado soluciones basadas en IA experimentan mejoras superiores al 25% en su competitividad internacional.

"El 78.3% de PYMES exportadoras que adoptan procesos de IA

mejoran su competitividad en un 25%"

¿Qué hace única esta revolución? Tres factores clave:

- Velocidad de adopción: Mientras el comercio electrónico tardó 20 años en transformar los mercados, la IA está logrando impactos similares en solo 36 meses.

- Efecto democratizador: Herramientas que antes costaban millones ahora están al alcance de PYMES gracias a modelos de chatbox como ChatGPT y soluciones en la nube.

- Impacto transversal: Desde aduanas hasta marketing, ningún eslabón de la cadena comercial escapa a esta transformación.

En este artículo profundizaremos en:

- El informe de la OMC sobre IA y Comercio

- La IA como aliado logístico

- Casos ejemplo de aplicación de la IA en diferentes sectores económicos

Los Hallazgos Clave del Informe de la OMC sobre IA y comercio mundial (2024)

El informe «El Impacto de la IA en el Comercio Internacional» es el análisis más completo realizado hasta la fecha, con datos de 184 países y más de 5,000 empresas.

Los principales resultados de este informe son los siguientes:

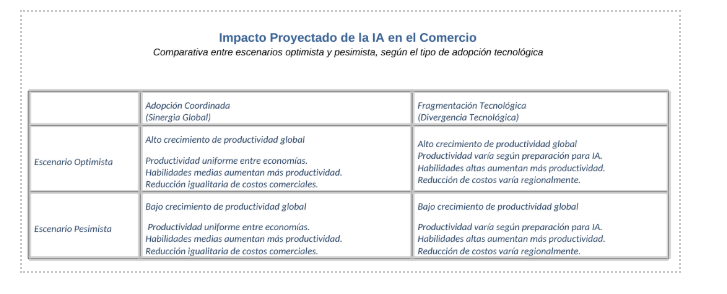

- Proyecciones de Crecimiento del comercio internacional gracias a la IA: Dos Escenarios distintos

El modelo de simulación de la OMC plantea dos escenarios para 2040:

Escenario Optimista

El cual se basa en el supuesto de la adopción coordinada de los procesos de IA por parte de todos los países dentro el comercio internacional. Lo que daría lugar a los siguientes resultados:

- Crecimiento del 14% del comercio mundial para 2024 (equivalente a 2.8 billones $ adicionales)

- Los servicios digitales liderarían el comercio mundial con un crecimiento del 18%.

- Los países en desarrollo reducirían sus costos comerciales hasta en un 22%

Escenario Pesimista:

El cual se basa en el supuesto de la existencia de una fragmentación tecnológica en el que el desarrollo de la IA se diera de manera distinta en determinadas zonas o países. Lo que daría lugar a los siguientes resultados:

- Crecimiento de sólo el 7% del comercio mundial para 2040.

- El 75% de los beneficios se concentrarían en 5 economías (EE.UU., China, UE, Japón y Corea del Sur)

- Aumento de la brecha digital (solo 1 de cada 4 PYMES en países emergentes adoptarían procesos de IA)

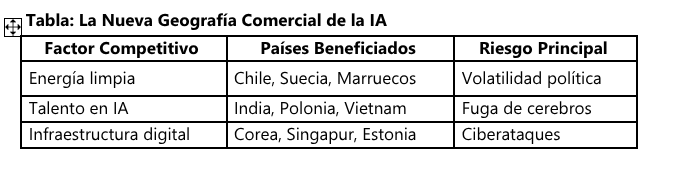

- La Reconfiguración de las Cadenas Globales de Valor

Durante la mayor parte del informe se señala claramente como la IA está alterando las cadenas de valor globales y por tanto se están alterando los patrones tradicionales de comercio, mediante:

Aparición de Nuevas ventajas comparativas, por ejemplo:

- Países con energía renovable barata como Chile y Marruecos atraen centros de datos

- Aparición de economías con talento especializado como India, que dominan los servicios de IA

Aparición de dependencias críticas, con especial mención a la dependencia existente en microchips y tierra radas, debido a que:

- El 95% de los chips avanzados dependen de TSMC (Taiwán) y Samsung. Tal y como señalábamos en nuestro blog publicado en la sección de Geopolítica Comercial: “La Importancia del Mar del Sur de China y el Dominio de los Microchips”

- Las Barreras Emergentes

El estudio también identifica 3 amenazas principales para el desarrollo de los procesos de IA en el comercio internacional:

- Fragmentación regulatoria: En el año 2024 existían 186 regulaciones distintas sobre IA frente sólo a las 22 regulaciones que existían en 2018. Todo esto conlleva un costo de cumplimiento para las PYMES de 142.000$ de media.

- Asimetrías tecnológicas: Debido a que el 89% de las patentes de IA son de EE.UU. (43%) y China (46%), mientras en el África subsahariana solo representa el 0.3% de inversión global en IA.

- Impacto climático: Ya que entrenar un modelo avanzado emite 284 toneladas de CO₂, lo que equivale a 25 vuelos Nueva York-Londres

La IA como aliado logístico revolucionario en los procesos aduaneros

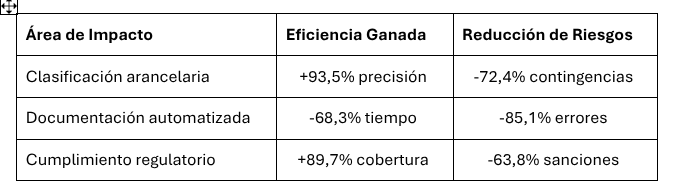

Como se ha comentado anteriormente, uno de los ámbitos en los que mayor impacto está teniendo la IA es en las operaciones logísticas internacionales y de manera muy especial en los procesos aduaneros.

En un reciente estudio publicado por la Comisión Europea denominado «Informe de la Comisión Europea sobre Aduanas 4.0″ se describe muy bien cómo la inteligencia artificial está revolucionando los procesos aduaneros; siendo las principales áreas en las que la IA está teniendo un mayor impacto:

- Los procesos de clasificación arancelaria, en la que gracias al desarrollo de la IA se está llegando a logar una reducción de más del 72% de las contingencias; lo que conlleva a tener ya modelos de clasificación arancelaria con más de un 93% de precisión.

Ésta es una de las principales áreas donde gracias a la IA se está produciendo un cambio significativo en la estructura del comercio mundial. Tal es su importancia que la siguiente publicación de este apartado sobre Comercio Internacional la dedicaremos exclusivamente a desarrollar mediante ejemplos prácticos las últimas novedades en este campo.

- La documentación automatizada, en el que mediante los diferentes procesos de IA aplicados se está llegando a tener una reducción del más del 85% de los errores que tradicionalmente se cometían, lo que está dando lugar a una reducción de más de 68% en el tiempo de procesamiento de la documentación en aduana.

- El cumplimiento regulatorio, en el que debido a los programas de IA desarrollados se está logrando en reducir en cerca de un 64% las sanciones aduaneras dando lugar a su vez a un incremento de cerca del 90% de la cobertura de todos los procesos.

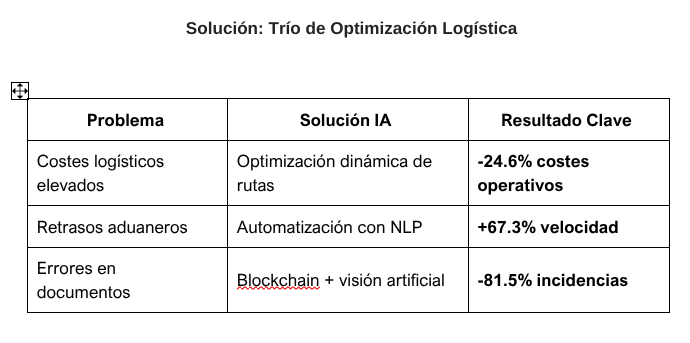

Elevado retorno de la Inversión en IA

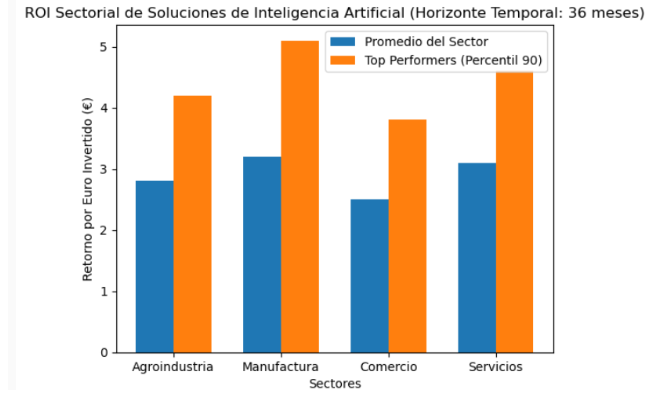

Una de las cuestiones de las que menos se habla, pero que más importante es tanto para los inversores como para el desarrollo de las tecnologías de IA en general es el retorno de las inversiones, y sobre todo contestar a la eterna pregunta si vale la pena invertir en IA.

Para hablar de esta cuestión, hemos analizado informe elaborado por PwC, denominado: “Sizing the prize: AI’s trillion-dollar opportunity». Dicho informe analiza, entre otras cuestiones, el retorno de la inversión en IA por sectores señala datos y conclusiones muy contundentes, aún teniendo en cuenta que como no podía ser de otra manera, la inversión en IA y el retorno de la misma varía por sector.

De hecho, como podemos observar en el grafico el sector de manufactura destaca con los mayores retornos entre todos los sectores analizados; lo que indica que existe un fuerte potencial para que las soluciones de IA impulsen la eficiencia y la rentabilidad en la industria manufacturera. Estamos hablando que en este sector las empresas líderes llegan a lograr un retorno de la inversión (ROI) de 5,1 veces en apenas 36 meses.

Destacando también otros tres sectores en el que el retorno de la inversión se llega a situar en cifras entre el 3 y 5 veces la inversión. Así, podemos destacar el sector de servicios con un ROI promedio de 3,1 veces escalando hasta 4,6 veces en implementaciones avanzadas, el sector del comercio con un ROI del 3,5 veces y el sector agroindustria con un ROI del de 2,8 veces.

Además, según podemos observar en el gráfico, las diferencias entre los promedios sectoriales y los mejores desempeños sugieren que hay un margen significativo de mejora dentro de cada sector para lograr mayores retornos mediante una mejor implementación y utilización de soluciones de IA.

Ante la pregunta si vale la pena invertir en IA, la respuesta está clara:

No es que valga la pena invertir,

es que para cualquier empresa exportadora es fundamental invertir en IA

y más si eres una PYME exportadora.

Casos Ejemplo de aplicación IA en diferentes sectores de internacionalización.

Como continuación del análisis de las ventajas y oportunidades que la IA proporciona a las PYMES exportadoras, ofrecemos varios casos ejemplo de éxito de aplicación de la IA en tres de los principales sectores del comercio mundial: sector agroalimentario, sector textil y automoción.

Sector agroalimentario: Industria Vitivinícola

Problemas actuales del sector vinícola

El sector vitivinícola, especialmente en denominaciones de origen, se enfrenta a desafíos críticos que limitan su competitividad internacional, principalmente:

- Un Margen bruto internacional estancado en el 18%, muy por debajo del potencial del sector.

- Un elevado número de errores en pedidos que afectan al 22% de las operaciones, generando costes logísticos y pérdida de confianza en clientes.

- Unos Plazos aduaneros prolongados (5.3 días en promedio) que suponen un lastre para entrega oportuna de los productos.

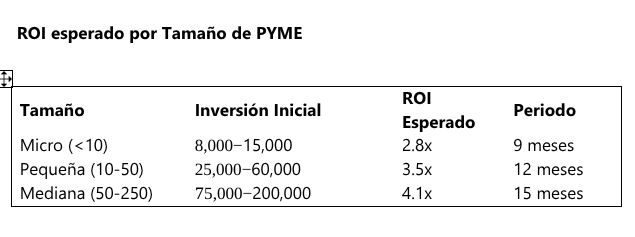

Solución: Desarrollo de procesos de IA centrado en la Demanda, el Control de Calidad y la Gestión Documental

Los resultados de este proceso de implantación de IA han originado resultados espectaculares que ha propiciado que el sector vinícola haya podido dar un salto importante en competitividad en tan sólo 12 meses

“En un mundo donde el vino viaja más que nunca,

la IA es el mejor sommelier para la logística”

Sector Textil Premium

Otro de los sectores que queremos analizar por su importancia es el sector textil, en el cual existe un verdadero problema de pérdidas millonarias en el sector premium, debido principalmente a tres grandes obstáculos a los que se enfrentan estas marcas:

- Elevado número de devoluciones: El 27 % de los productos comprados se devuelven principalmente por errores en tallas.

- Inventario estancado: Con sólo 2 rotaciones anuales, muchas colecciones no llegan al público y acababan muriendo en los almacenes.

- Logística inversa insostenible: En el que casi el 9% de las ventas se consume en gestionar devoluciones.

En definitiva, se tiene un modelo de negocio donde cada 4 prendas vendidas, 1 termina de vuelta en stock.

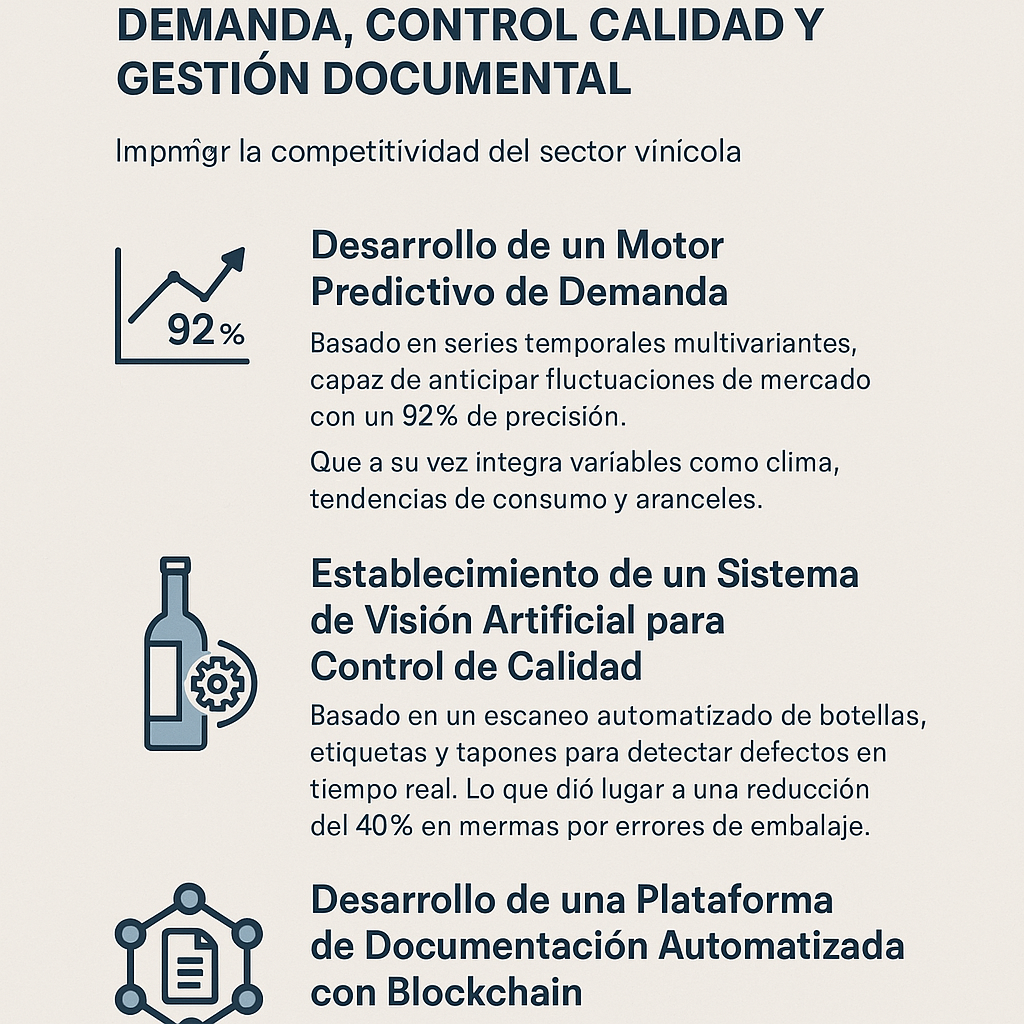

Solución:

Establecimiento de un proceso de IA basado en el desarrollo de Un Trio Tecnológico Disruptivo

“En estos momentos la moda ya no es

arte + artesanía…

es arte + algoritmos”.

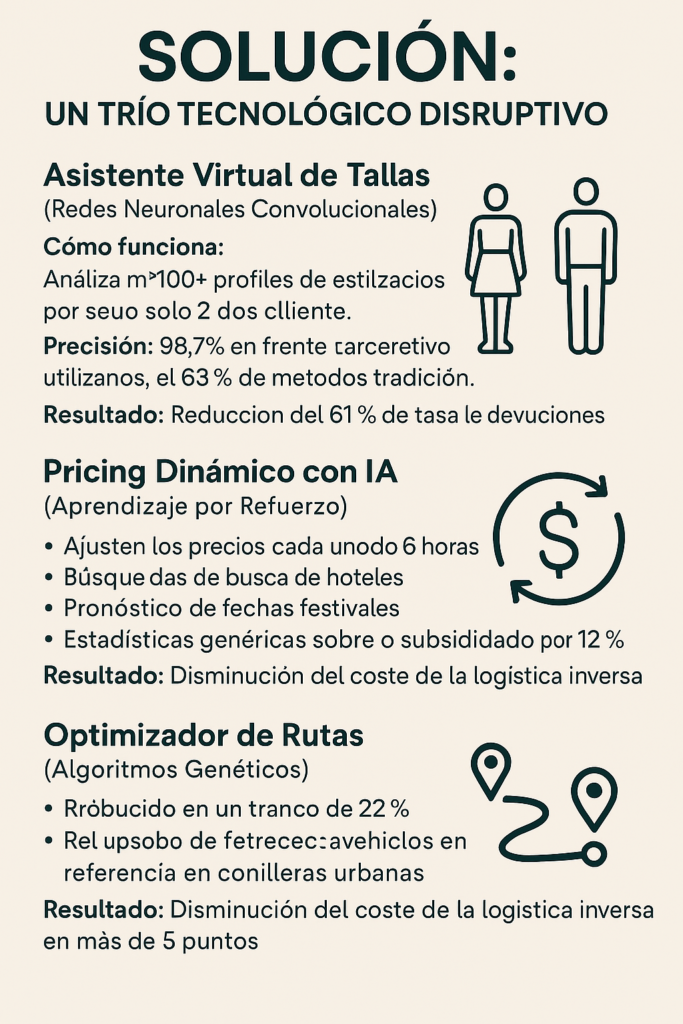

Componentes de Automoción

El sector automoción, y principalmente las PYMES, se enfrenta a tres problemas importantes:

- Elevadas ineficiencias logísticas, ligadas a rutas no optimizadas, sobrecostes de transporte y gestión manual de inventarios. De manera que las PYMES del sector automotriz llegan a perder hasta un 38 % de su margen en estas ineficiencias logísticas.

- Retrasos aduaneros: En el que el 28 % de las operaciones sufren retrasos por errores en documentación o desconocimiento normativo, dando lugar a un tiempo medio de 5-7 días en aduanas con los sobrecostes por almacenamiento que esto conlleva.

- Elevados procesos de documentación: Que da lugar a que prácticamente el 33% de los envíos tengan que volver a enviarse por documentación incorrecta.

"En el comercio internacional,

la IA es como el sistema de navegación de un vehículo:

Sin ella, el camino es más largo, costoso y lleno de imprevistos.

Con ella, cada kilómetro (y cada envío) se optimiza al máximo."

Conclusión: La IA, un Pilar Indispensable en la Internacionalización

Las PYMES que desean competir con éxito en los mercados globales no pueden permitirse ignorar la Inteligencia Artificial.

Los datos son irrefutables: la IA no solo optimiza costes y procesos, sino que también abre puertas a nuevas oportunidades comerciales, mejora el cumplimiento normativo y aumenta la satisfacción del cliente obteniendo retornos a la inversión muy elevados.

Integrar la IA en el plan de internacionalización ya no es una opción, sino una necesidad estratégica. Desde la logística hasta el marketing, pasando por la gestión aduanera, las herramientas basadas en IA están demostrando ser el diferencial que separa a las empresas que crecen de las que se quedan atrás.

La internacionalización ya no se limita a mercados tradicionales.

Con la IA como aliada, las PYMES pueden explorar nuevos horizontes con mayor agilidad y menos riesgos, asegurando una presencia global competitiva y sostenible.

Y recordad ahora más que nunca… ¡HAY VIDA MÁS ALLÁ DE TURQUÍA!

Roulette strategies often miss the mark, but creative tools like Sprunked Incredibox remind us why play matters-music, math, and fun collide beautifully here.

It’s so important to remember gaming should be fun, not a source of stress. Seeing platforms like arionplay app focus on a smooth, secure experience is great – responsible enjoyment is key! Let’s all play it safe. 😊

That’s a fascinating take on recent race results! Seeing platforms like phlboss online casino cater to Filipino players with diverse games is interesting – adds another layer to entertainment options beyond the track! Good analysis.

Love being able to bet on the go with 12betmobile. The mobile site is really well-optimized. It’s easier to get in on the action! Use this 12betmobile link to place your bets.

Anyone download the bg678gamedownloadapk yet? Wondering if it’s legit. Always a bit wary about downloading APKs, you know? Has there been malware or anything found, and is it worth it? Get the APK here — at your own risk haha: bg678gamedownloadapk

Ready to get back in the game? The BHT Club login page can be a little tricky to find sometimes. This might get you there quicker: bhtclubgamelogin

Estrelabet is hitting the spot! Great odds and a clean interface. Had a blast playing here last night. I recommend giving it a shot: estrelabet

Need the IN999 app? in999download is the place to get it! Fast, easy, and haven’t had any problems with the download itself. Get the app here: in999download.

GMC Slot, heard good things. The graphics are top-notch. Might be worth a spin or two if you’re feeling lucky: gmc slot.

Alright everyone, anyone tried out plataforma592bet? I’m curious what the vibe is over there, lemme know if you’ve got any experience! plataforma592bet

Hey, just wanted to drop a line about 622betapp. Gives it a shot, it’s got some pretty interesting bits. I think it’s solid. 622betapp

What’s up, anybody here heard of or used plataformawin222? Looking for some real talk on it before I dive in. Hit me up with your thoughts! plataformawin222

82jl https://www.go82jl.net

jiliko – Jiliko Online Casino Philippines: Secure Jiliko Login, Register, App Download & Best Slots. Experience Jiliko Online Casino Philippines! Enjoy secure Jiliko login, fast Jiliko register, and top Jiliko slots. Jiliko app download now for the best PH gaming. visit: jiliko

[2289]kkkjili Casino: Login, Register & App Download | Free Bonus Experience the best of kkkjili Casino in the Philippines. Register now to claim your free bonus, download our app, and enjoy easy login to premium slots and live games. visit: kkkjili